Your Digital Money Lives on the Blockchain

Imagine your wallet… but only you hold the key. No banks, no middlemen—just you managing your digital fortune directly.

Welcome to the world of crypto wallets and blockchain: the place where your actual money lives—secure, private, and boundaryless.

- How wallets don’t “store” money—they store control.

- Different types of wallets—hot, cold, software, hardware.

- How blockchain makes it all possible.

- Real-world security challenges, including hacks and emerging threats.

- Institutional adoption, and what the future holds.

1. What Is a Crypto Wallet?

A crypto wallet doesn’t hold coins; it holds private keys, the only thing granting access to funds on the blockchain:

- The public key is your account number—shared to receive crypto.

- The private key is your secret PIN—used to sign, send, and secure funds

Without your private key, nobody—not even you—can move funds. Wallets are more like digital vaults than banks.

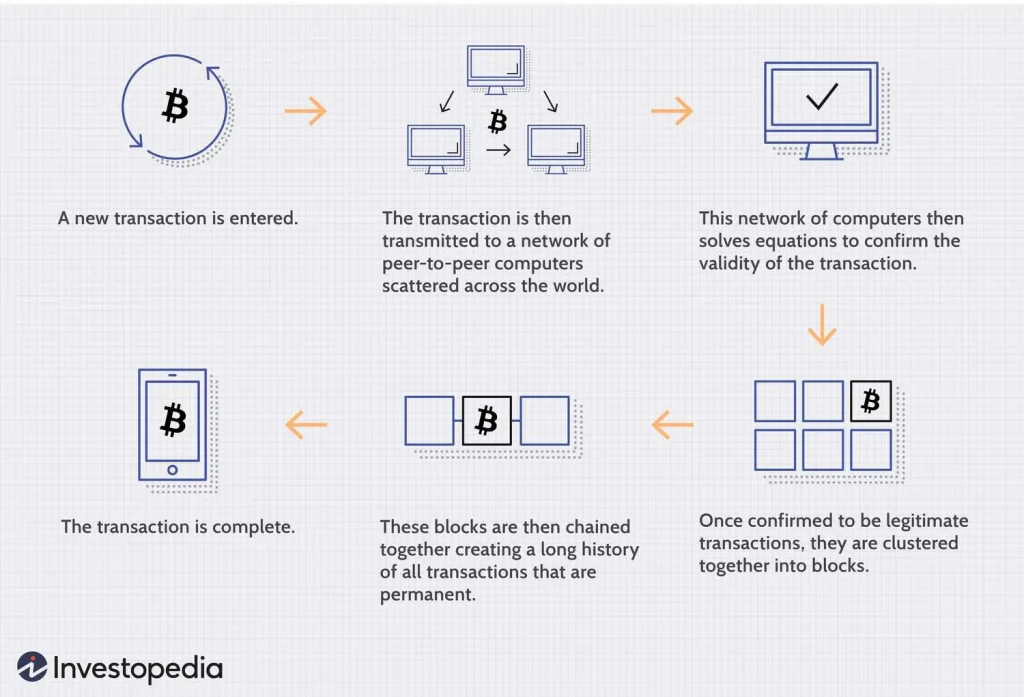

2. How Blockchain Makes It Work

Blockchain is a distributed, tamper-proof ledger shared across participants. It records every transaction in blocks that link together securely.

- Consensus algorithms like Proof-of-Work (Bitcoin) or Proof-of-Stake (Ethereum) defend the network.

- Wallets tap into this to check your balance and authorize transactions.

3. Types of Wallets: Hot vs. Cold

The right wallet depends on your needs:

| Wallet Type | Definition | Pros | Cons |

|---|---|---|---|

| Hot Wallet (software/apps) | Online, convenient access | Fast transactions, easy swaps, DeFi integration | Vulnerable to hacks |

| Cold Wallet (hardware/paper) | Offline, secure storage | Private keys never touch internet, highly safe | Less convenient, must guard physical device |

| Custodial Wallet | Keys held by third party (exchanges) | Easy access, KYC supported | Risk of hacks, lack of true ownership |

| Non-Custodial Wallet | You control the keys | Maximum privacy and ownership | Responsibility for backups, loss risk |

4. Security Best Practices & Real Risks

Blockchain Security

Blockchain itself is secure, protected by cryptography and network consensus. Yet vulnerabilities lie in wallet implementation.

Wallet Hacks & Custodial Risks

High-profile hacks, like the recent $1.5B Bybit breach, show centralized custody carries major risks. Scams, phishing, and ransomware thrive because blockchain transactions are irreversible

Safer Wallet Practices

- Use cold, non-custodial wallets for long-term storage.

- Secure seed phrases offline; never share them

- Enable 2FA and IP whitelisting on platforms

- Regularly update firmware to patch issues .

5. Wallet Innovations & Trends

In 2025, wallets are evolving into Web3 super apps:

- Integrate staking, token swaps, DeFi, and NFT support

- Hardware wallets are adopting post-quantum encryption and zero-knowledge proofs to guard against future threats

Tools like WalletProbe are being developed to automate vulnerability testing, prompting safer design

6. Blockchain in Finance & Institutions

Major firms are broadening beyond Bitcoin:

- Financial institutions are gravitating toward Ethereum, seeking staking returns and DeFi exposure .

- Blockchain in finance extends to tokenization, smart securities, and digitizing assets—supported by regulations .

Wallets are central to this shift—bridging traditional finance and decentralized ecosystems.

7. Top Wallet Picks in 2025

Reputable wallet recommendations:

- Exodus – multi-asset software wallet, Trezor support.

- Zengo – keyless wallet for beginners.

- MetaMask – gateway to Ethereum and Web3.

- Electrum – established Bitcoin wallet .

- Tangem – NFC-powered hardware cards rated top for convenience and security

8. Challenges & Considerations

- Usability vs security: balancing convenience with risk.

- Education gap: users often unaware of private key importance.

- Regulatory uncertainties: custody laws, taxation, and clarity needed.

- Future-proofing: wallets must resist quantum threats

9. What the Future Holds

- Integration of identity verification, self-sovereign identity systems tied to wallets .

- Expansion of DeFi and tokenized assets into mainstream finance.

- Broader institutional use and regulated wallet ecosystems.

Your Wallet = Ownership

Your crypto wallet isn’t just a tool—it’s where you actually hold your money. Its security, keys, and interface define your digital financial freedom.

By understanding wallet types, security measures, and the evolving ecosystem, you can safely navigate the crypto frontier. This isn’t simply about technology; it’s about empowerment, responsibility, and financial sovereignty.

Blockchain isn’t just a buzzword—it’s the backbone of secure, decentralized finance. And your crypto wallet? It’s not where your money is, it’s where your keys live.

These keys unlock your digital assets on the blockchain, which is public, tamper-proof, and scattered across thousands of computers globally.

Hot wallets give you speed and convenience, but are vulnerable to hacks. Cold wallets offer airtight security but sacrifice quick access. The article deep dives into both, helping you choose what fits your crypto lifestyle.

- How wallets interact with the blockchain

- The importance of private keys

- Tips to avoid scams and hacks

- The future of wallet technology with AI & biometrics

“It’s not about where your crypto lives—it’s about how you protect your access to it.”

So, whether you’re investing $10 or $10,000—understanding your wallet is understanding your wealth.