Picture this: You’re scrolling through social media, and you see your college friend posting about their “mining rig” with more LED lights than a nightclub.

They’re claiming to make passive income while they sleep, and you’re wondering if you should quit your day job to become a digital prospector.

Welcome to the wild world of blockchain mining—where electricity bills can make you cry, but the promise of cryptocurrency riches keeps you up at night.

Blockchain Mining Demystified

Blockchain mining is like being a digital accountant, security guard, and lottery player all rolled into one—except instead of wearing a suit, you’re probably in pajamas, and instead of using a calculator, you’re using a computer that sounds like a jet engine taking off.

In simple terms, blockchain mining is the process of validating transactions on a blockchain network and adding them to the distributed ledger.

Miners compete to solve complex mathematical problems, and the winner gets rewarded with cryptocurrency.

It’s basically a global math competition where the prize is digital money, and the entry fee is your electricity bill.

But before you start dreaming of Lamborghinis and early retirement, let’s dive deep into what is blockchain mining really about,

how it works, and whether you should even bother trying it in 2025.

What Is Blockchain Mining? The Basics

The Simple Explanation

Think of blockchain mining as being a bookkeeper for the world’s most paranoid accounting firm.

Every transaction needs to be verified, recorded, and agreed upon by multiple parties before it’s considered legitimate. Miners are the volunteers (well, paid volunteers) who do this verification work.

The Technical Explanation

Blockchain mining is the computational process where miners:

- Collect transactions from the network’s memory pool

- Verify each transaction for legitimacy

- Create a block containing these verified transactions

- Solve a cryptographic puzzle to “seal” the block

- Broadcast the solution to the network

- Receive cryptocurrency rewards if their solution is accepted

Key Components of Blockchain Mining

| Component | Function | Analogy |

|---|---|---|

| Hash Function | Creates unique digital fingerprints | Like a tamper-proof seal |

| Nonce | Variable number that miners change | Like trying different keys |

| Difficulty | How hard the puzzle is to solve | Like adjusting the lock complexity |

| Block Reward | Payment for successful mining | Like a salary for good work |

How Does Blockchain Mining Work?

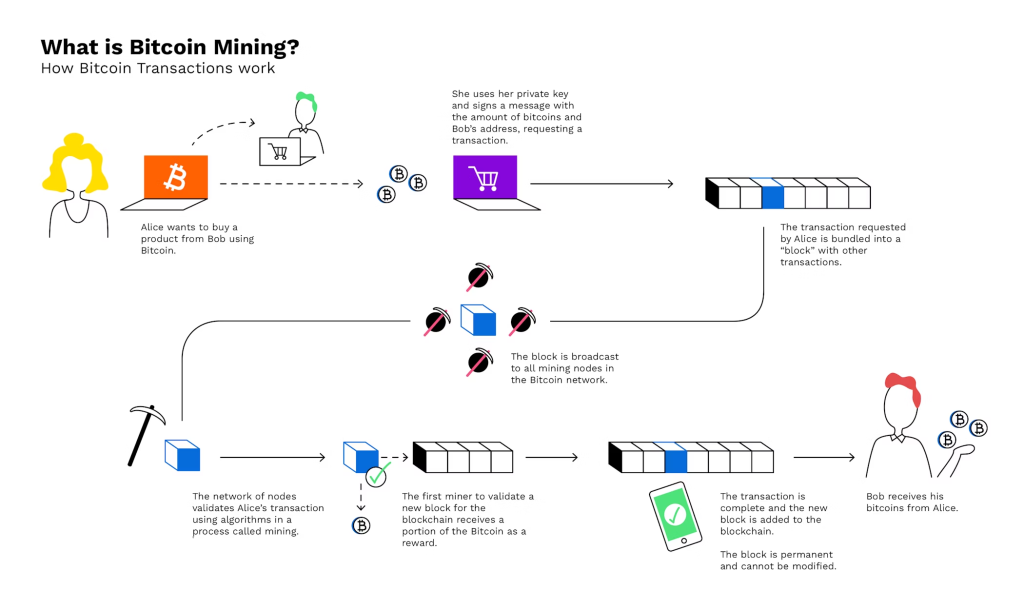

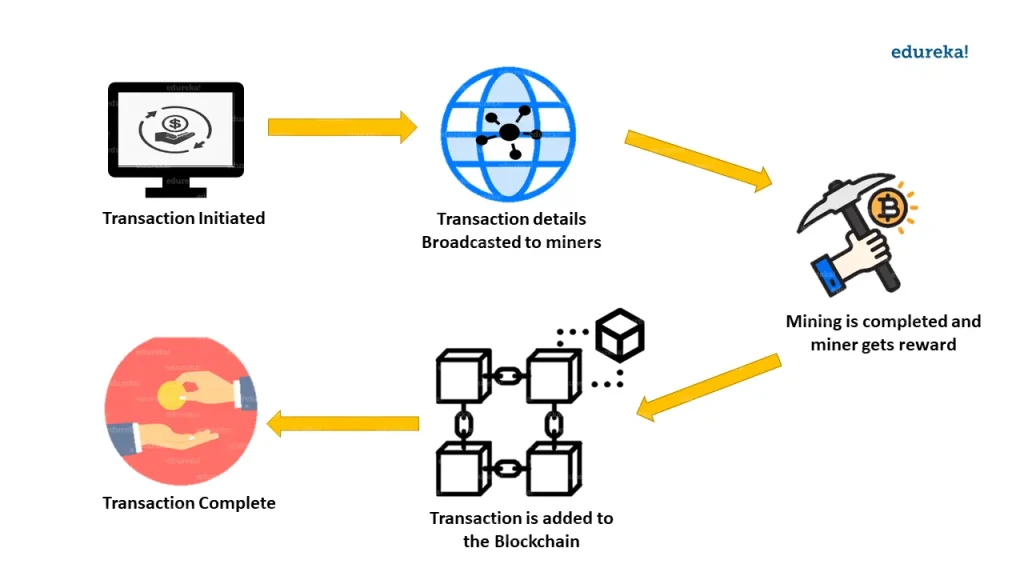

The Mining Process: Step by Step

Step 1: Transaction Collection

Miners gather pending transactions from the network’s memory pool (mempool). It’s like collecting mail that needs to be sorted and delivered.

Step 2: Transaction Verification

Each transaction is checked for validity:

- Does the sender have enough funds?

- Are the digital signatures correct?

- Is the transaction format proper?

Step 3: Block Creation

Valid transactions are bundled into a block, along with:

- Block header information

- Timestamp

- Reference to the previous block

- Merkle root (a summary of all transactions)

Step 4: The Mining Race

Here’s where it gets interesting. Miners compete to solve a cryptographic puzzle by finding a “nonce” (number used once) that, when combined with the block data, produces a hash meeting specific criteria.

Step 5: Proof of Work

The puzzle requires massive computational power but is easy to verify. It’s like asking someone to find a specific grain of sand on a beach—difficult to do, but easy to check if they found the right one.

Step 6: Block Validation and Reward

The first miner to solve the puzzle broadcasts their solution. Other miners verify it, and if correct, the block is added to the blockchain. The winning miner receives:

- Block reward (newly minted cryptocurrency)

- Transaction fees from included transactions

Mining Difficulty: The Auto-Adjusting Challenge

Blockchain mining networks automatically adjust difficulty to maintain consistent block creation times.

If miners are solving puzzles too quickly, the difficulty increases. If too slowly, it decreases. It’s like a video game that adjusts its difficulty based on how well you’re playing.

Types of Blockchain Mining

Proof of Work (PoW) Mining

What it is: The original blockchain mining method used by Bitcoin and many other cryptocurrencies.

How it works: Miners compete to solve computational puzzles using processing power.

Pros:

- Highly secure and battle-tested

- Truly decentralized

- Transparent and predictable

Cons:

- Extremely energy-intensive

- Requires expensive hardware

- Increasing difficulty over time

Proof of Stake (PoS) Mining

What it is: A newer consensus mechanism where validators are chosen based on their stake in the network.

How it works: Instead of competing with computational power, validators are selected to create blocks based on their holdings and other factors.

Pros:

- Much more energy-efficient

- Lower barrier to entry

- Scalable

Cons:

- Less battle-tested than PoW

- Potential for centralization

- “Rich get richer” dynamics

Cloud Mining

What it is: Renting blockchain mining power from remote data centers.

How it works: You pay a company to mine cryptocurrency on your behalf using their hardware.

Pros:

- No hardware investment required

- No electricity costs

- Professional management

Cons:

- Often unprofitable

- Risk of scams

- Less control over operations

Pool Mining vs. Solo Mining

| Aspect | Pool Mining | Solo Mining |

|---|---|---|

| Rewards | Smaller, frequent payouts | Large, infrequent payouts |

| Consistency | Steady income | Lottery-like |

| Fees | Pool fees (1-3%) | No fees |

| Risk | Lower variance | Higher variance |

| Suitable for | Most miners | Large operations |

Hardware and Software Requirements

Hardware Options for Blockchain Mining

CPU Mining

- What it is: Using your computer’s processor to mine

- Profitability: Practically zero for major cryptocurrencies

- Best for: Learning and very small altcoins

GPU Mining

- What it is: Using graphics cards for mining

- Hardware needed: High-end graphics cards (RTX 4090, RX 7900 XTX)

- Cost: $1,000-$2,000 per card

- Profitability: Moderate, depending on electricity costs

ASIC Mining

- What it is: Specialized hardware designed specifically for mining

- Hardware needed: Application-Specific Integrated Circuits

- Cost: $2,000-$15,000+ per unit

- Profitability: Highest for Bitcoin mining

FPGA Mining

- What it is: Field-Programmable Gate Arrays

- Hardware needed: Specialized programmable chips

- Cost: $2,000-$10,000

- Profitability: Good for specific algorithms

Essential Software for Mining

Mining Software:

- CGMiner: Popular open-source mining software

- BFGMiner: Modular ASIC/FPGA miner

- NiceHash: User-friendly with automatic algorithm switching

- PhoenixMiner: Optimized for Ethereum mining

Wallet Software:

- Hardware wallets: Ledger, Trezor for security

- Software wallets: Exodus, Electrum for convenience

- Exchange wallets: Binance, Coinbase for trading

The Economics of Mining: Costs, Profits, and Challenges

Initial Investment Breakdown

Hardware Costs:

| Mining Setup | Initial Cost | Monthly Revenue | Break-even Time |

|---|---|---|---|

| Basic GPU Rig | $3,000-$5,000 | $100-$300 | 12-18 months |

| High-end GPU Farm | $20,000-$50,000 | $1,000-$3,000 | 15-24 months |

| ASIC Miner | $5,000-$15,000 | $500-$1,500 | 8-15 months |

| Large Mining Farm | $100,000+ | $5,000-$20,000+ | 12-20 months |

Ongoing Operational Costs

Electricity: The biggest expense for miners

- Residential rates: $0.10-$0.30 per kWh

- Industrial rates: $0.05-$0.15 per kWh

- Ideal for mining: Under $0.10 per kWh

Cooling and Ventilation:

- Air conditioning: $100-$500 monthly

- Industrial cooling: $1,000+ monthly

- Proper ventilation: Critical for hardware longevity

Maintenance and Repairs:

- Hardware replacement: 10-20% annually

- Technical support: $500-$2,000 monthly

- Downtime costs: Lost mining revenue

Profitability Factors

Network Hash Rate:

Higher network hash rate = increased difficulty = lower individual profits

Cryptocurrency Prices:

Mining profitability directly correlates with coin prices

Mining Difficulty:

Auto-adjusting mechanism that affects mining rewards

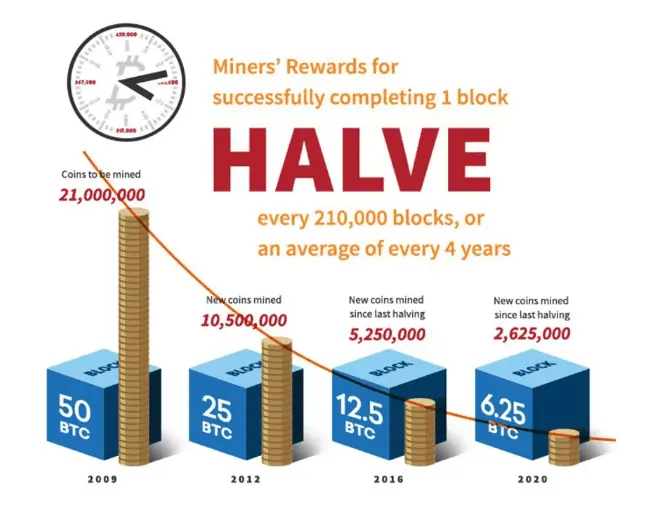

Block Rewards:

Periodic halvings reduce mining rewards over time

Environmental Impact: The Energy Debate

The Energy Consumption Reality

Bitcoin Network Stats:

- Annual energy consumption: ~150 TWh (comparable to Argentina)

- Carbon footprint: ~65 million tons CO2 annually

- Energy per transaction: ~700 kWh

Why Mining Uses So Much Energy:

- Proof of Work design: Intentionally requires computational power

- Security through energy: More energy = more secure network

- Competition: Miners must keep upgrading to stay competitive

Environmental Mitigation Efforts

Renewable Energy Adoption:

- Solar-powered mining farms

- Hydroelectric mining operations

- Wind energy integration

Efficiency Improvements:

- More efficient mining hardware

- Better cooling systems

- Optimized mining software

Alternative Consensus Mechanisms:

- Proof of Stake (99% less energy)

- Proof of Authority

- Delegated Proof of Stake

Is Blockchain Mining Still Worth It in 2025?

Factors Working Against Mining

Increased Competition:

- More miners = less profit per miner

- Professional mining farms dominate

- Hobbyist miners struggle to compete

Rising Costs:

- Expensive hardware

- Increasing electricity rates

- Regulatory compliance costs

Technical Challenges:

- Complex setup and maintenance

- Constant monitoring required

- Technical expertise needed

Factors Working For Mining

Institutional Adoption:

- Growing cryptocurrency acceptance

- Corporate mining investments

- Government recognition

Technological Improvements:

- More efficient hardware

- Better mining software

- Improved cooling solutions

Market Opportunities:

- New cryptocurrencies to mine

- Specialized mining services

- Mining-as-a-Service platforms

The 2025 Mining Landscape

Who Can Still Profit:

- Large-scale operations with cheap electricity

- Miners in regions with renewable energy

- Specialized mining service providers

- Those mining new, less competitive coins

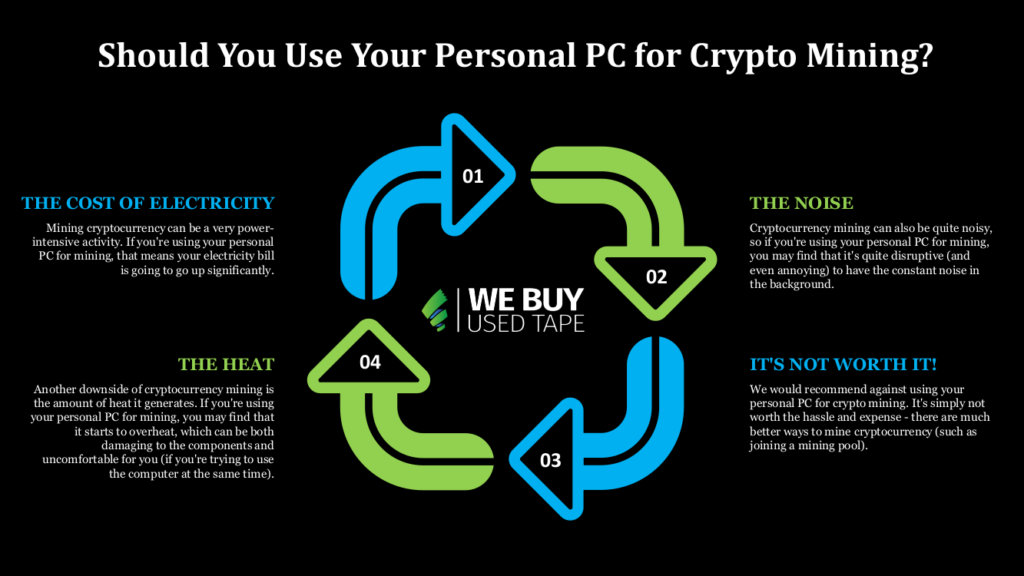

Who Should Avoid Mining:

- Casual hobbyists without technical knowledge

- Those paying high electricity rates

- Investors looking for quick profits

- People unwilling to commit long-term

Common Mistakes and Risks to Avoid

Financial Mistakes

Underestimating Costs:

- Forgetting about electricity bills

- Ignoring cooling and ventilation costs

- Not budgeting for hardware replacement

Overestimating Profits:

- Using outdated profitability calculators

- Assuming constant cryptocurrency prices

- Ignoring difficulty adjustments

Poor Timing:

- Buying hardware at peak prices

- Starting mining during bull markets

- Not considering market cycles

Technical Mistakes

Inadequate Infrastructure:

- Insufficient electrical capacity

- Poor ventilation systems

- Unreliable internet connections

Security Oversights:

- Weak wallet security

- Unsecured mining operations

- Poor backup strategies

Maintenance Neglect:

- Irregular hardware cleaning

- Outdated software

- Ignoring temperature monitoring

Legal and Regulatory Risks

Compliance Issues:

- Ignoring local regulations

- Tax reporting failures

- Permit and licensing oversights

Insurance Gaps:

- Uninsured mining equipment

- Liability coverage gaps

- Business interruption risks

The Funny Side of Mining: Memes, Misconceptions, and Miner Life

Popular Mining Memes and Misconceptions

“It’s Free Money!”

Reality: Mining is more like running a 24/7 business with razor-thin margins, not a magical money printer.

“I’ll Just Mine While I Sleep”

Reality: Mining rigs are louder than a construction site and hotter than a sauna. Good luck sleeping!

“GPU Mining is Dead”

Reality: Reports of GPU mining’s death have been greatly exaggerated. It’s just evolved.

The Daily Life of a Home Miner

6 AM: Wake up to the sound of mining rig fans (who needs an alarm clock?)

6:15 AM: Check overnight mining stats while still in bed

7 AM: Discover one GPU crashed overnight, spend 30 minutes troubleshooting

8 AM: Explain to spouse why the electricity bill is $400 this month

9 AM: Research new mining strategies while coffee gets cold

10 AM: Order more fans because the garage is now 90°F

Evening: Watch mining revenue fluctuate every five minutes

Night: Dream about cryptocurrency prices and wake up checking phone

Mining Murphy’s Laws

- Hardware will fail on weekends when tech support is closed

- Electricity will go out during the most profitable mining period

- Cryptocurrency prices will crash right after you buy new equipment

- Your loudest mining rig will be in the room next to your bedroom

- The most profitable coin will become unprofitable the day you switch to it

Future of Blockchain Mining: Trends and Innovations

Emerging Technologies

Green Mining Initiatives:

- Solar-powered mining farms

- Waste heat utilization

- Carbon-negative mining operations

AI-Optimized Mining:

- Predictive maintenance

- Automated profit switching

- Intelligent cooling systems

Quantum-Resistant Mining:

- Quantum-proof algorithms

- Post-quantum cryptography

- Future-proof security measures

Market Developments

Regulatory Clarity:

- Government frameworks for mining

- Tax guidance for miners

- Environmental regulations

Institutional Mining:

- Corporate mining operations

- Mining-backed securities

- Professional mining services

Decentralized Mining:

- Home mining renaissance

- Peer-to-peer mining pools

- Community-owned mining farms

Innovation Predictions for 2025-2030

Hardware Evolution:

- More efficient ASIC miners

- Consumer-friendly mining devices

- Modular mining systems

Software Improvements:

- Better mining pool software

- Advanced profitability tools

- Automated mining management

Business Model Innovation:

- Mining-as-a-Service platforms

- Fractional mining ownership

- Gamified mining experiences

Should You Even Try Blockchain Mining?

After diving deep into the world of blockchain mining, the answer to “should you even try it?” is the classic consultant response: “It depends.”

You Should Consider Mining If:

You Have Cheap Electricity (under $0.10 per kWh)

- This is the most critical factor for profitability

- Without cheap power, you’re essentially donating money to the electric company

You’re Technically Inclined

- Mining requires troubleshooting skills

- You’ll need to optimize settings and maintain hardware

- Problem-solving is a daily occurrence

You Can Commit Long-term

- Mining is not a get-rich-quick scheme

- Profitability comes from consistent operation over time

- Market cycles require patience and persistence

You Have Adequate Space and Infrastructure

- Mining generates heat and noise

- Proper ventilation is essential

- Electrical capacity must be sufficient

You Should Avoid Mining If:

You’re Looking for Quick Profits

- Mining is a business, not a lottery ticket

- Returns are measured in months and years, not days

You Pay High Electricity Rates

- Anything above $0.15 per kWh makes mining challenging

- Residential rates often make mining unprofitable

You Can’t Handle Technical Challenges

- Mining requires ongoing maintenance

- Hardware failures are common

- Technical knowledge is essential

You’re Risk-Averse

- Cryptocurrency prices are volatile

- Mining difficulty changes constantly

- Regulatory changes can impact profitability

Blockchain mining in 2025 is not the gold rush it once was, but it’s also not completely dead. It’s evolved into a professional industry where success depends on:

- Efficiency over raw power

- Location and energy costs

- Technical expertise and optimization

- Long-term thinking over short-term gains

Our Verdict: If you have cheap electricity, technical skills, and realistic expectations, blockchain mining can be a worthwhile venture.

If you’re looking for easy money or passive income, you’d be better off investing in index funds.

Remember, the most successful miners treat it as a business, not a hobby. They calculate costs, optimize operations, and plan for the long term.

The question isn’t whether you should try blockchain mining—it’s whether you should try it seriously or not at all.

Start small, learn the ropes, and scale up gradually. The world of blockchain mining is complex, competitive, and constantly changing.

But for those who approach it with the right mindset and preparation, it can be a fascinating and potentially profitable journey into the future of digital currency.