Reliance Industries Limited (RIL), India’s largest private sector company, has delivered an exceptional performance in the first quarter of FY26.

Led by Asia’s richest man Mukesh Ambani, the diversified conglomerate has achieved its highest-ever quarterly net profit, marking a significant milestone that has exceeded market expectations and reinforced investor confidence in the company’s strategic direction.

Key Financial Highlights

Record Net Profit Surge of 78%

Reliance Industries recorded a consolidated net profit of ₹26,994 crore in Q1 FY26, representing a remarkable 78% year-on-year growth from ₹15,138 crore in the corresponding quarter of the previous year.

This figure significantly outperformed street estimates of ₹22,069 crore, demonstrating the company’s robust operational efficiency and strategic execution capabilities.

Steady Revenue Growth Across Segments

The company’s operating revenue reached ₹2,48,660 crore, marking a 5.3% increase from ₹2,36,217 crore in the previous year. Total revenue stood at ₹2,73,252 crore, representing a 6% year-on-year growth.

This consistent revenue expansion across multiple business verticals showcases the strength of RIL’s diversified business model.

EBITDA Performance Exceeds Expectations

Reliance’s EBITDA (Earnings Before Interest, Tax, Depreciation, and Amortization) surged to ₹58,024 crore, marking a substantial 36% increase from ₹42,748 crore in the previous year.

The EBITDA margin improved significantly by 460 basis points, rising from 16.6% in Q1 FY25 to 21.2% in the current quarter, indicating enhanced operational efficiency and better cost management.

10 Key Takeaways from Reliance Q1 FY26 Results

1. Asian Paints Stake Sale Boosts Exceptional Gains

A significant contributor to Reliance’s stellar net profit growth was the one-time gain of ₹8,924 crore from the sale of its stake in Asian Paints.

However, even excluding this exceptional income, the company’s recurring profit demonstrated a robust 25% growth, highlighting the underlying strength of its core business operations.

2. Jio Platforms Delivers Outstanding Growth

Jio Platforms showcased exceptional performance across all metrics:

- Net profit increased by 25% to ₹7,110 crore

- EBITDA grew by 24% to ₹18,135 crore

- JioTrue5G users crossed 200 million milestone

- Total subscriber base reached 498.1 million

- Added 9.9 million new subscribers during the quarter

- Maintained industry-leading data consumption of 37 GB per subscriber per month

3. ARPU Improvement Reflects Pricing Strategy Success

Jio’s Average Revenue Per User (ARPU) reached ₹208.8, benefiting from recent tariff increases and seasonal factors.

This improvement demonstrates the success of the company’s strategic pricing initiatives while maintaining customer loyalty and market leadership position.

4. Reliance Retail’s Robust Expansion

Reliance Retail Ventures delivered impressive growth metrics:

- Gross revenue increased by 11.3% to ₹84,171 crore

- Net profit surged by 28% to ₹3,271 crore

- EBITDA grew by 12.7% to ₹6,381 crore

- Maintained industry-leading 8.7% EBITDA margin

- Added 388 new stores during the quarter

- Expanded registered customer base to 358 million

5. Comprehensive Retail Network Expansion

Reliance Retail continued its aggressive expansion strategy:

- Total network of 19,592 stores

- Combined area of 77.6 million square feet

- Pan-India presence across multiple retail formats

- Strategic focus on high-growth urban and semi-urban markets

6. Oil-to-Chemicals (O2C) Segment Resilience

Despite challenging market conditions, the O2C segment showed resilience:

- EBITDA increased by 10.8% to ₹14,511 crore

- Revenue declined marginally by 1.5% to ₹1,54,804 crore

- EBITDA margin improved to 9.4%

- The revenue decline was primarily attributed to lower crude oil prices and planned maintenance shutdowns

7. Oil & Gas Exploration Faces Headwinds

The Oil & Gas segment experienced some pressure:

- Revenue declined by 1.2% to ₹6,103 crore

- EBITDA decreased by 4.1% to ₹4,996 crore

- Lower KG-D6 gas sales volume impacted performance

- However, maintained a high EBITDA margin of 81.9%

8. Digital Services Innovation Drive

Jio’s digital services portfolio demonstrated excellent performance:

- JioMart Quick hyper-local daily orders grew by 175% YoY

- JioHotstar achieved 652 million digital viewers for IPL

- JioAirFiber became the world’s largest FWA service with 7.4 million customers

- Strong momentum in digital ecosystem expansion

9. Financial Position Strengthens Further

The company’s financial metrics showed significant improvement:

- Other income quadrupled to ₹15,119 crore from ₹3,983 crore in the previous year

- Capital expenditure of ₹29,875 crore ($3.5 billion)

- Finance costs increased by 18.9%, primarily due to 5G spectrum asset operationalization

10. Management’s Optimistic Outlook

Mukesh Ambani’s Statement: “Reliance has started FY26 with strong all-around operational and financial performance.

Despite significant volatility in global macro, consolidated EBITDA for Q1 FY26 saw strong year-on-year improvement.”

Ambani further emphasized that the performance and growth initiatives give him confidence that Reliance will continue its excellent track record of doubling every 4-5 years.

Market Performance and Investor Confidence

Outstanding Share Price Performance

Reliance shares gained 17.7% during the quarter, significantly outperforming the benchmark Nifty 50 index.

In 2025, the company has achieved a 22% price appreciation compared to just 6% gains in the Nifty 50 index, demonstrating strong investor confidence in the company’s strategic direction.

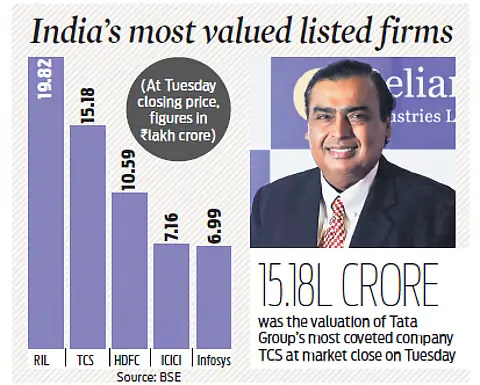

Market Capitalization Growth

Reliance has added $40 billion in market value in 2025, accounting for nearly one-third of the total value addition in the benchmark index.

This remarkable growth reflects strong investor confidence in Mukesh Ambani’s leadership and the company’s diversified business model.

Future Strategy and Growth Initiatives

Digital Expansion Plans

Reliance is accelerating its digital services expansion:

- AJIO Rush service now provides 4-hour delivery across six cities

- AJIO’s catalog expanded to 2.6 million options, showing 44% YoY growth

- Continued investment in digital infrastructure and customer experience enhancement

Retail Innovation and Growth

Reliance Retail is expanding with new formats and brands:

- New formats including GAP, Azorte, and Yousta showed 59% YoY growth

- Focus on strengthening FMCG brands portfolio

- Strategic emphasis on omnichannel retail experience

Energy Sector Stability

Despite energy market uncertainties, Reliance maintained:

- Margin resilience across energy verticals

- Favorable margins on domestic fuel retail

- Strategic hedging against commodity price volatility

Challenges and Risk Factors

Global Economic Uncertainties

The company faces volatile crude oil pricing environment.

Increased uncertainty in energy markets remains a persistent challenge requiring strategic navigation and operational flexibility.

Operational Challenges

Planned maintenance shutdowns resulted in volume declines in certain segments.

However, these are temporary impacts and part of the company’s long-term operational strategy to maintain asset integrity and efficiency.

Business Segment Analysis

Telecom Segment Excellence

Jio’s telecom business continues to dominate:

- Market leadership in 4G and 5G services

- Premium subscriber acquisition strategy yielding results

- Digital services integration creating ecosystem stickiness

- Network quality and coverage advantages sustained

Retail Segment Expansion

Reliance Retail’s multi-format approach:

- Fashion and lifestyle segments showing strong growth

- Grocery and daily essentials gaining market share

- Electronics and digital products driving higher margins

- Private label development enhancing profitability

Petrochemicals and Energy

O2C segment strategic positioning:

- Integration advantages providing cost competitiveness

- Product mix optimization improving margins

- Global market exposure diversifying revenue sources

- Capacity utilization efficiency maintaining profitability

Innovation and Technology Leadership

5G Network Rollout Success

Jio’s 5G deployment represents a technological milestone:

- Fastest 5G rollout globally

- True 5G technology providing superior experience

- Enterprise solutions creating new revenue streams

- IoT and edge computing capabilities development

Digital Platform Integration

RIL’s digital ecosystem strategy:

- Cross-platform synergies enhancing user engagement

- Data analytics driving personalized services

- AI and machine learning implementation across businesses

- Cloud infrastructure supporting digital transformation

Sustainability and ESG Initiatives

Green Energy Transition

Reliance’s commitment to sustainability:

- Renewable energy investments accelerating

- Carbon neutrality targets for 2035

- Green hydrogen production capabilities development

- Circular economy principles adoption

Social Impact Programs

Community development initiatives:

- Education and healthcare access improvement

- Rural development programs expansion

- Skill development and employment generation

- Digital inclusion initiatives nationwide

Competitive Advantages and Market Position

Scale and Integration Benefits

RIL’s competitive moat includes:

- Vertical integration across value chains

- Scale economies in procurement and operations

- Brand recognition and customer loyalty

- Distribution network reach and efficiency

Financial Strength

Strong balance sheet characteristics:

- Robust cash generation from operations

- Diversified revenue streams reducing risk

- Strategic investments in growth areas

- Debt management maintaining optimal capital structure

Reliance Industries’ Q1 FY26 performance demonstrates the strength of its diversified business model and strategic execution capabilities.

The company’s ability to deliver record financial results while maintaining growth across telecom, retail, and petrochemicals segments reflects exceptional management quality and operational excellence.

Jio’s rapid 5G expansion, Reliance Retail’s consistent growth, and O2C segment’s resilience position the company well for sustained long-term growth.

Mukesh Ambani’s vision of “doubling every 4-5 years” appears increasingly achievable given the current performance trajectory and strategic initiatives.

For investors, Reliance represents a compelling long-term investment opportunity that is excellently positioned to benefit from India’s growing digital and consumer economy.

The company’s diversified portfolio and continuous focus on innovation help it navigate market volatilities while capitalizing on emerging opportunities.

Reliance Industries’ Q1 FY26 results not only showcase financial excellence but also establish a new benchmark in the Indian corporate landscape.

This performance validates the company’s strategic vision, operational efficiency, and market leadership across multiple business verticals, making it a cornerstone investment for those seeking exposure to India’s long-term growth story.