Blockchain technology has long been marketed as “unhackable” due to its decentralized architecture and cryptographic security.

Yet, 2025 has already witnessed over $3.1 billion in cryptocurrency losses from various blockchain-related hacks, surpassing the entire 2024 total of $2.85 billion.

This stark reality raises a critical question: if blockchain is so secure, why do hacks still happen?

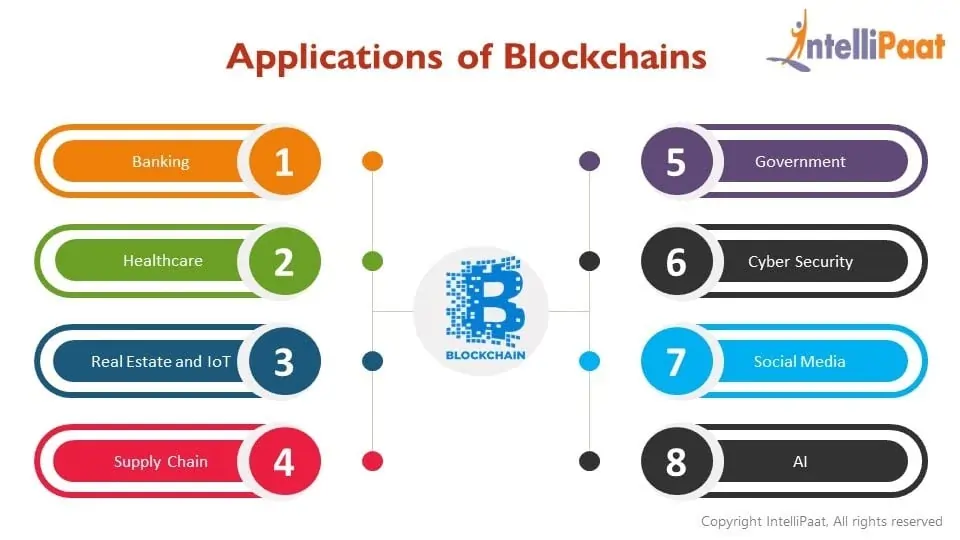

The answer lies in understanding that while the core blockchain protocol itself remains extremely secure, the ecosystem built around it—smart contracts, exchanges, wallets, and human interactions—contains numerous vulnerabilities that attackers consistently exploit.

Let’s explore the seven primary reasons why blockchain hacks continue to plague the industry.

Understanding Blockchain’s Core Security vs. Ecosystem Vulnerabilities

The Blockchain Foundation: Actually Secure

The underlying blockchain technology relies on three fundamental security principles:

- Decentralization: No single point of failure; data distributed across multiple nodes

- Cryptographic Hashing: Each block contains the previous block’s hash, making tampering detectable

- Consensus Mechanisms: Network agreement required for transaction validation

These features make altering historical blockchain data extremely difficult. For major networks like Bitcoin and Ethereum, achieving a successful attack would require enormous computational resources and costs.

The Vulnerable Ecosystem

However, blockchain applications operate within a complex ecosystem where security is only as strong as the weakest link.

Most hacks target these peripheral components rather than the blockchain itself.

7 Primary Reasons Why Blockchain Hacks Still Occur

1. Smart Contract Vulnerabilities: The $263 Million Problem

Smart contracts are self-executing programs with terms directly written into code. While revolutionary, they’re only as secure as the code written to protect them.

In 2025, smart contract vulnerabilities contributed to approximately 8% of total crypto losses, amounting to $263 million.

Common Smart Contract Flaws:

- Reentrancy Attacks: Malicious contracts repeatedly call functions before previous executions complete

- Integer Overflow/Underflow: Mathematical errors causing unexpected behavior

- Logic Flaws: Poor coding practices creating exploitable loopholes

- Oracle Manipulation: Attackers controlling external data feeds to trigger false conditions

A study analyzing 3,759 smart contracts found that 3,686 were vulnerable to hacking, highlighting the widespread nature of this problem.

2. Access Control Failures: The Dominant Threat

Access control exploits account for 59% of all crypto losses in 2025, representing the primary attack vector. These attacks target the human and process-level weaknesses rather than cryptographic flaws.

Access Control Attack Methods:

- Private Key Compromise: Weak password protection or phishing attacks

- Insider Threats: Malicious employees with privileged access

- Social Engineering: Manipulating humans to reveal sensitive information

- Blind Signing Attacks: Tricking users into authorizing malicious transactions

As Hacken’s forensics head noted: “Attackers have shifted focus from exploiting cryptographic flaws to targeting human and process-level weaknesses”.

3. The 51% Attack: Controlling the Consensus

A 51% attack occurs when a single entity controls more than half of a blockchain’s computational power. This allows attackers to:

- Double-spend cryptocurrency

- Reverse confirmed transactions

- Block new transactions from confirming

- Create fraudulent blockchain versions

Why It Happens:

- Smaller blockchains are vulnerable: Less computational power required for control

- Mining pool concentration: Large pools can potentially coordinate attacks

- Economic incentives: Potential profits outweigh attack costs

Historical Example: Ethereum Classic suffered three 51% attacks in 2020, each costing currency holders $9 million through double transactions.

4. Exchange and Wallet Security Failures

Even with secure blockchains, centralized exchanges and wallets remain prime targets. These platforms store large amounts of cryptocurrency in “hot wallets” connected to the internet, making them vulnerable to traditional cybersecurity attacks.

Major 2025 Exchange Breaches:

- ByBit hack: $1.5 billion stolen in February 2025

- CoinDCX breach: Significant losses due to inadequate security measures

Common Exchange Vulnerabilities:

- Inadequate security practices

- API vulnerabilities

- Insider threats

- Poor transaction signing protocols

5. Phishing and Social Engineering Attacks

Human error remains the most exploitable vulnerability in blockchain systems. Attackers use sophisticated phishing campaigns to steal private keys and credentials.

Phishing Attack Methods:

- Fake wallet interfaces: Mimicking legitimate platforms

- Fraudulent email campaigns: Requesting private key information

- Social media scams: Impersonating trusted figures

- SIM swapping: Taking control of phone numbers for 2FA bypass

The decentralized nature of blockchain means stolen funds are often unrecoverable, making phishing attacks particularly devastating.

6. Routing and Network-Level Attacks

Routing attacks target the internet infrastructure connecting blockchain nodes rather than the blockchain itself. Attackers intercept data transfers between nodes and internet service providers.

How Routing Attacks Work:

- Traffic interception: Capturing data during transmission

- Network partitioning: Isolating nodes from the main network

- Double-spending facilitation: Exploiting network delays

- Transaction manipulation: Altering or blocking transactions

These attacks are particularly dangerous because participants typically cannot detect the threat while it’s occurring.

7. DeFi Protocol Exploits: The $1.2 Billion Flash Loan Attack

Decentralized Finance (DeFi) platforms have introduced new attack vectors through complex financial protocols.

The largest DeFi exploit in 2025 resulted in over $1.2 billion in losses through sophisticated flash loan manipulation.

DeFi Attack Mechanisms:

- Flash loan exploitation: Borrowing large amounts to manipulate markets within single transactions

- Bridge vulnerabilities: Exploiting cross-chain communication protocols

- Governance attacks: Manipulating voting mechanisms

- Liquidity pool manipulation: Artificial price manipulation for profit

The $700 Million Bridge Hack: A vulnerability in blockchain bridge validator design enabled hackers to mint counterfeit tokens, highlighting the risks of cross-chain interoperability.

The Technical Reality: Blockchain vs. Applications

Core Blockchain Remains Secure

It’s crucial to understand that no major blockchain network has been successfully hacked at the protocol level.

Bitcoin and Ethereum’s core systems remain mathematically secure due to their:

- Massive computational requirements for successful attacks

- Distributed validator networks preventing centralized control

- Economic disincentives making attacks prohibitively expensive

Application Layer Vulnerabilities

The problems arise in the application layer built on top of blockchains:

- Smart contracts with coding errors

- Centralized exchange infrastructure

- User interface vulnerabilities

- Third-party integrations

- Human operational errors

Why Attacks Are Increasing Despite Better Security

Growing Attack Surface

As the blockchain ecosystem expands, the attack surface grows exponentially:

- More DeFi protocols with complex interactions

- Increased institutional adoption creating larger targets

- Cross-chain bridges introducing new vulnerabilities

- Legacy code exploitation in older systems

Sophisticated Attacker Methods

Modern attackers employ increasingly sophisticated techniques:

- Multi-vector attacks combining different exploit methods

- Advanced social engineering targeting specific individuals

- AI-powered phishing creating more convincing scams

- Zero-day exploits in newly discovered vulnerabilities

Prevention Strategies: Building True Security

For Developers

Smart Contract Security:

- Comprehensive code audits by security specialists

- Formal verification of critical contract functions

- Bug bounty programs to identify vulnerabilities

- Regular security updates for legacy systems

Infrastructure Security:

- Multi-signature wallets for fund management

- Cold storage for majority of assets

- Redundant security systems with failsafes

- Regular penetration testing

For Users

Personal Security Measures:

- Hardware wallets for cryptocurrency storage

- Strong, unique passwords with 2FA enabled

- Verification of URLs before entering credentials

- Education about phishing techniques

Due Diligence:

- Research platform security before using services

- Check audit reports for DeFi protocols

- Use reputable exchanges with insurance coverage

- Understand risks before participating in new protocols

For Organizations

Enterprise Security Framework:

- Regular security assessments of all blockchain systems

- Employee training on blockchain security risks

- Incident response plans for potential breaches

- Insurance coverage for cryptocurrency holdings

The Future of Blockchain Security

Emerging Security Technologies

Advanced Defense Mechanisms:

- Formal verification tools for smart contract validation

- AI-powered threat detection systems

- Quantum-resistant cryptography for future-proofing

- Zero-knowledge proofs for enhanced privacy and security

Regulatory and Industry Response

Strengthening the Ecosystem:

- Stricter security standards for exchanges and platforms

- Mandatory security audits for DeFi protocols

- Insurance requirements for cryptocurrency businesses

- International cooperation on cybercrime prevention

Security in a Decentralized World

The persistence of blockchain hacks despite the technology’s inherent security highlights a fundamental truth: security is a systemic challenge, not just a technological one.

While blockchain protocols themselves remain highly secure, the surrounding ecosystem—from smart contracts to human interfaces—continues to present vulnerabilities.

Critical Understanding Points:

- The blockchain itself is secure; applications built on it often aren’t

- Human factors remain the weakest link in blockchain security

- Centralized components (exchanges, wallets) introduce traditional security risks

- Smart contract code quality directly impacts security outcomes

- Education and best practices are essential for users and developers

The $3.1 billion in losses during 2025 serves as a stark reminder that blockchain adoption must be accompanied by robust security practices at every level.

As the technology matures, the focus must shift from simply building on blockchain to building securely on blockchain.

Understanding these vulnerabilities isn’t meant to discourage blockchain adoption but to promote informed participation in this revolutionary technology.

By recognizing where risks exist and implementing appropriate safeguards, users and organizations can harness blockchain’s benefits while minimizing exposure to its current limitations.