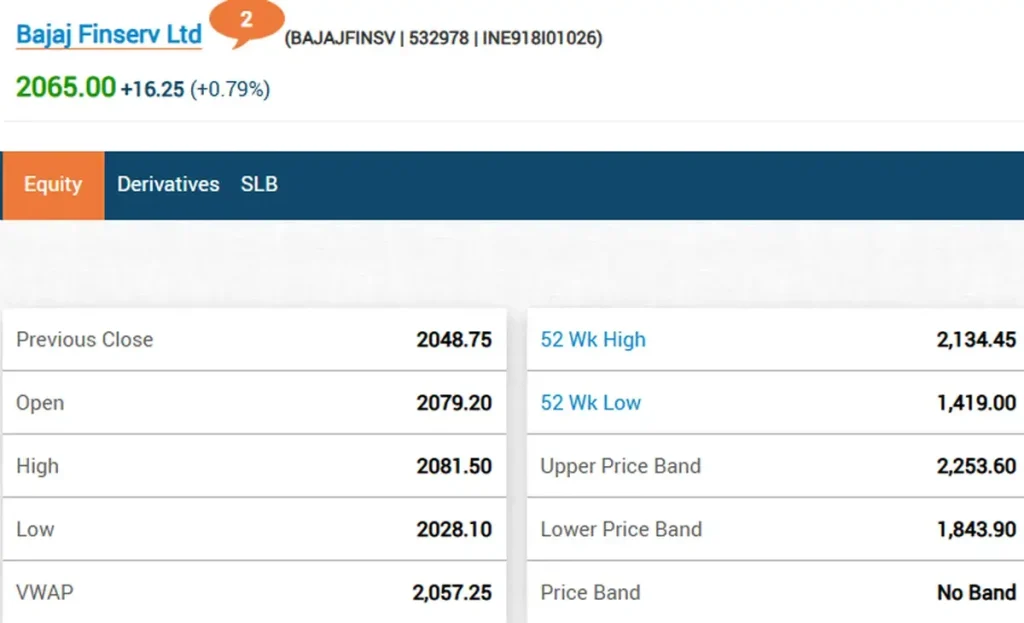

Bajaj Finance Stock Tanks 6% After Q1 Results 2025: Bajaj Finance shares witnessed a dramatic selloff on July 25, 2025, crashing over 6% to an intraday low of Rs 898 despite reporting robust Q1 FY26 financial results.

The stock emerged as one of the biggest losers on Nifty 50, reflecting investor concerns about emerging stress in key business segments and rising credit costs.

The sharp decline came as a surprise to many market participants, considering the company delivered a 22% year-on-year jump in consolidated net profit to Rs 4,765 crore.

However, underlying concerns about asset quality deterioration and management guidance have overshadowed the headline growth numbers.

Q1 FY26 Financial Performance: Mixed Bag of Results

Strong Top-Line Growth

Bajaj Finance demonstrated impressive growth metrics in its Q1 FY26 performance:

- Net Profit: Rose 22% YoY to Rs 4,765 crore

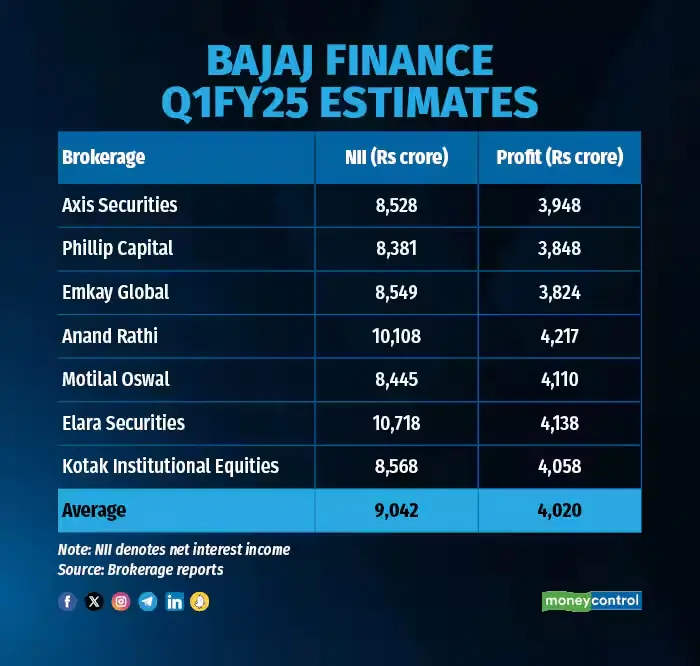

- Net Interest Income (NII): Increased 22% to Rs 10,227 crore

- Total Revenue: Grew 21.3% to Rs 19,524 crore

- Assets Under Management (AUM): Surged 25% to Rs 4.41 lakh crore

- Customer Additions: Added 4.69 million new customers

Concerning Asset Quality Trends

Despite strong growth numbers, several red flags emerged:

- Gross NPA: Rose to 1.03% from 0.96% in Q4 FY25

- Provisions for Bad Loans: Jumped 26% to Rs 2,120 crore

- Credit Costs: Increased to 2.02% annually

- Provision Coverage Ratio: Declined by 160 basis points sequentially

MSME Segment Stress: The Core Concern

Management’s Cautious Outlook

The primary factor behind the stock’s decline stems from management’s acknowledgment of stress in the MSME portfolio, which constitutes 12% of total AUM. During the earnings call, management highlighted:

- Slowdown in MSME and Auto segments due to broader macroeconomic challenges

- Restructuring of MSME loans to address emerging stress

- Revised AUM growth guidance to 23-25% for FY26, showing increased caution

Sectoral Impact Analysis

The MSME stress is particularly concerning given:

- Two-wheeler and three-wheeler financing saw a 20% decline

- Auto loans segment showing signs of stress alongside MSME

- Broader economic slowdown impacting small business borrowers

Brokerage House Recommendations: Divided Street

Bullish Recommendations

JM Financial: Maintains Buy (Target: Rs 1,000)

- Acknowledges near-term concerns but remains positive on long-term prospects

- Expects NIM improvement of 10 basis points YoY

- Anticipates fee income growth of 13-15% in FY26

- Maintains credit cost guidance of 1.85-1.95%

HDFC Securities: Buy (Target: Rs 985)

- Highlights 24% AUM CAGR potential over FY26-FY27

- Notes improving operational efficiency post-pandemic investments

- Sees 9.7% upside potential from current levels

Jefferies: Buy (Target: Rs 1,100)

- Acknowledges strong fundamentals with 23% AUM growth over FY25-28

- Projects earnings CAGR of 23% and ROE of 20%

- Notes diversified loan mix can compensate for MSME pressures

Cautious and Bearish Views

Motilal Oswal: Neutral (Target: Rs 1,000)

- Maintains neutral stance citing valuation concerns

- Awaits more clarity on asset quality trends

JPMorgan: Downgrade

- Expressed concerns about upcoming stress in key segments

- Worried about impact on growth and profitability

UBS: Sell (Target: Rs 750)

- Among the most bearish with significant downside target

- Believes MSME stress will persist longer than expected

Macquarie: Underperform (Target: Rs 800)

- Argues stock not factoring in decline in growth guidance

- Anticipates higher credit costs if stress pool increases

- Notes 4.4x FY27 price-to-book appears expensive

Key Risk Factors and Challenges

Asset Quality Deterioration

The most pressing concern is the sequential rise in NPAs and provisions:

- Gross NPA increased to 1.28% in standalone business

- Provision coverage ratio decline indicates potential future stress

- SMA-2 accounts showing stress signals in MSME segment

Management Transition Uncertainty

Adding to investor concerns is the recent resignation of MD Anup Saha after just three months in the role. Rajeev Jain has resumed responsibilities until 2028, but succession planning remains a question mark.

Macroeconomic Headwinds

Broader economic challenges are impacting the NBFC:

- Slower economic growth affecting borrower repayment capacity

- Increased leverage among borrowers showing stress signs

- Sector-wide pressure on NBFCs due to rising funding costs

Investment Strategy: Buy, Hold or Sell?

Case for Buying the Dip

Long-term Growth Potential

- Market leadership position in consumer finance

- Diversified product portfolio reducing concentration risk

- Strong brand and distribution network

- Digital transformation initiatives improving efficiency

Attractive Valuations Post Correction

- 6% correction has improved risk-reward ratio

- Target prices of Rs 985-1,100 suggest 10-22% upside potential

- Strong capital adequacy of 21.96% provides buffer

Reasons for Caution

Near-term Headwinds

- MSME stress likely to persist for 2-3 quarters

- Rising credit costs will impact profitability margins

- Slower AUM growth may disappoint growth-focused investors

Valuation Concerns

- Premium valuations may not justify near-term risks

- 4.4x P/B ratio appears stretched given current challenges

Expert Verdict and Investment Recommendation

For Conservative Investors

Wait and Watch approach is recommended given:

- Uncertainty around MSME stress duration

- Management transition concerns

- Potential for further correction if Q2 results disappoint

For Aggressive Investors

Gradual Accumulation strategy makes sense because:

- Strong long-term fundamentals remain intact

- Market leadership in growing consumer finance space

- Correction provides better entry point for long-term wealth creation

Risk Management Strategy

Investors should consider:

- Staggered buying to average out volatility

- Position sizing appropriate to risk tolerance

- Monitoring Q2 results for MSME stress trends

- Stop-loss at Rs 850 to limit downside risk

Future Outlook and Key Monitorables

Q2 FY26 Key Metrics to Watch

- MSME portfolio performance and stress stabilization

- Credit cost trends and provision requirements

- AUM growth momentum across different segments

- Management commentary on FY26 guidance

Long-term Growth Drivers

- Digital lending expansion and fintech partnerships

- Rural and semi-urban market penetration

- New product launches and cross-selling opportunities

- Operational efficiency improvements from technology investments