Radhika Gupta’s Balanced Money Mantra

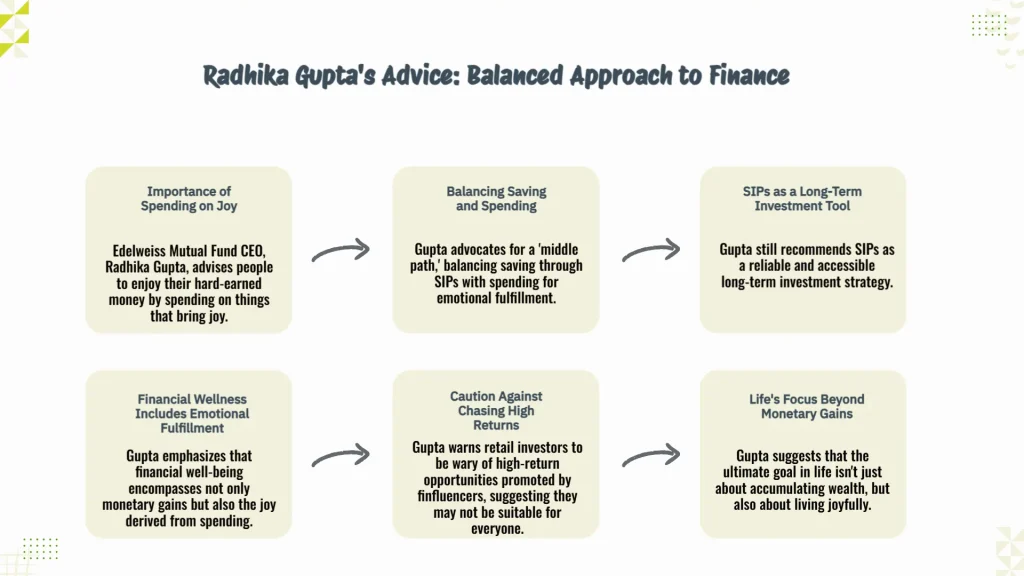

Radhika Gupta’s Balanced Money Mantra: Edelweiss Mutual Fund CEO Radhika Gupta advocates for a balanced approach to personal finance through her viral “middle path” philosophy.

Rather than extreme saving or spending, she emphasizes “Save, but also spend on things that give you joy.”

Her key message: life isn’t about accumulating the highest net worth.

While systematic investments like SIPs are crucial, planned spending on meaningful experiences prevents financial burnout and maintains motivation for long-term goals.

Gupta clarifies that SIPs are investment methods, not products, helping investors make informed decisions.

Her philosophy promotes financial discipline combined with mindful pleasure, ensuring wealth-building doesn’t sacrifice present happiness.

This balanced mantra resonates with modern investors seeking both prosperity and well-being.

What Happened?

Edelweiss Mutual Fund CEO Radhika Gupta used a reflective post on X (formerly Twitter) to remind followers that money management should balance prudence with pleasure. While she “sells SIPs,” Gupta insists life is not a contest of who amasses the biggest net worth.

“Save, but also spend on things that give you joy, because it makes the journey worth it.”

Her thread began with a Hindi couplet on starting a journey with a dream and celebrating small wins. She closed by praising “the middle path” between austerity and excess.

Key Takeaways

| Lesson | Explanation |

|---|---|

| 1. Balance Is Vital | Financial discipline matters, but occasional spending on meaningful experiences fuels happiness and avoids burnout. |

| 2. Money ≠ Scorecard | Gupta argues life success isn’t measured by highest NAV; fulfillment counts more. |

| 3. Clarify SIP vs MF | Many still confuse SIPs (a method of investing) with mutual funds (the vehicle). She urges investors to understand the distinction for better decisions. |

| 4. Simple Analogies Work | Gupta uses food metaphors—like choosing “full” or “half-plate” portions—to demystify finance and even tackle issues like obesity. |

| 5. Embrace the ‘Middle Path’ | Neither overspend nor hoard; a moderated approach builds wealth and well-being. |

Why Her Message Matters

- Mental Wellness: Chronic penny-pinching can cause stress; planned indulgences improve morale and productivity.

- Investor Engagement: Enjoying small rewards keeps long-term investors motivated to continue disciplined SIPs.

- Financial Literacy Gap: Clearing myths around SIPs, equities, and mutual funds helps Indians choose suitable products instead of blindly chasing returns.

Practical Tips Inspired by Gupta

- Automate core savings via SIPs, then set aside a defined “joy fund” (5-10% of income) for guilt-free spending.

- Review goals annually: adjust SIP amounts upward with income, but also list non-financial goals (travel, hobbies).

- Educate yourself: know that SIP is just a frequency tool; the underlying fund—equity, debt, hybrid—drives risk/return.

- Practice mindful buying: spend on experiences or items that align with personal values, not social pressure.

- Adopt ‘half-plate’ thinking: whether food portions or luxury purchases, opt for moderation to curb waste and overspending.

Broader Context

Gupta’s stance aligns with a growing movement in personal finance that blends Financial Independence principles with hedonic well-being research.

Economists note that happiness from spending often plateaus; strategically directing discretionary cash toward experiences, health, or learning yields outsized life satisfaction.

Radhika Gupta’s viral post serves as a timely reminder: money is a tool, not a tally. By balancing systematic saving with intentional spending, individuals can pursue financial goals without sacrificing present-moment joy.

Her “middle path” mantra offers a simple yet powerful framework for anyone striving for both prosperity and happiness.